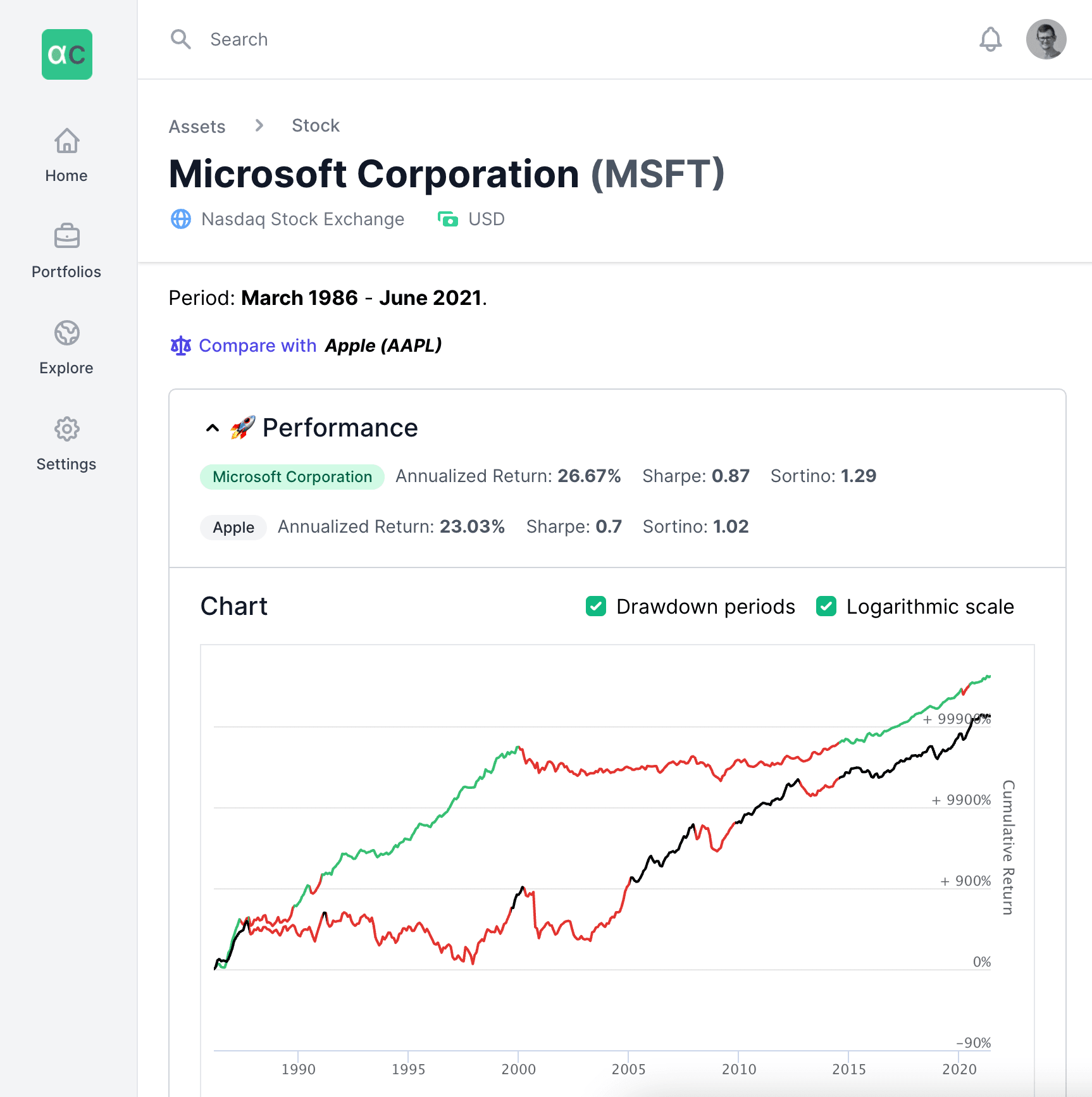

Analyze assets in a quantitative way

Make better informed decisions by analyzing your assets for risk and reward. How much return can I expect to make? How much risk am I taking? How does it compare to another asset? Our analysis tool got you covered. It's a great starting point to start constructing your own portfolio...

“Alphacubator gives me the most in-depth overview of my investments. I'm no longer left in the dark, no bad surprises since I know exactly how much I can expect to gain or lose from my portfolio.”

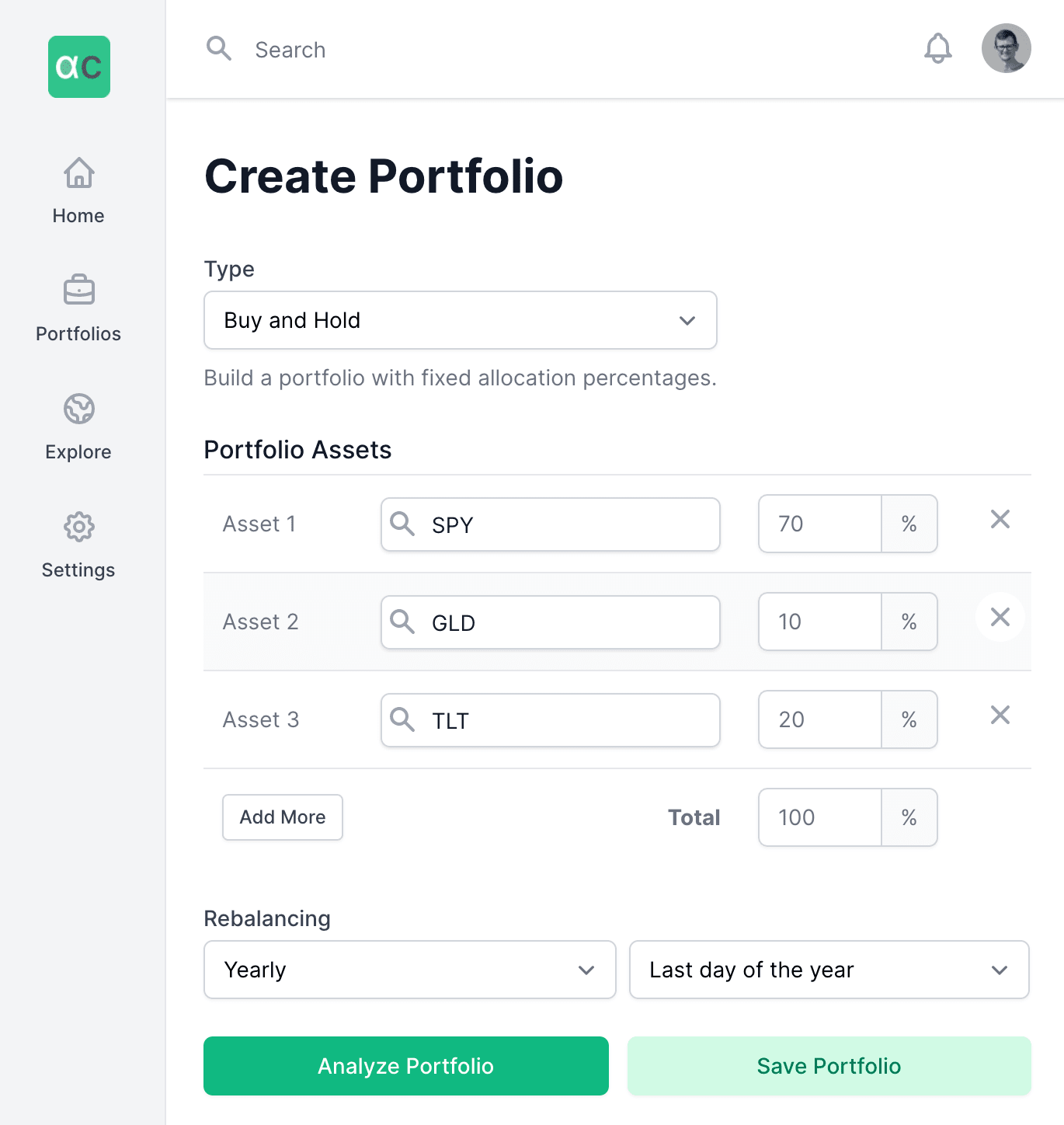

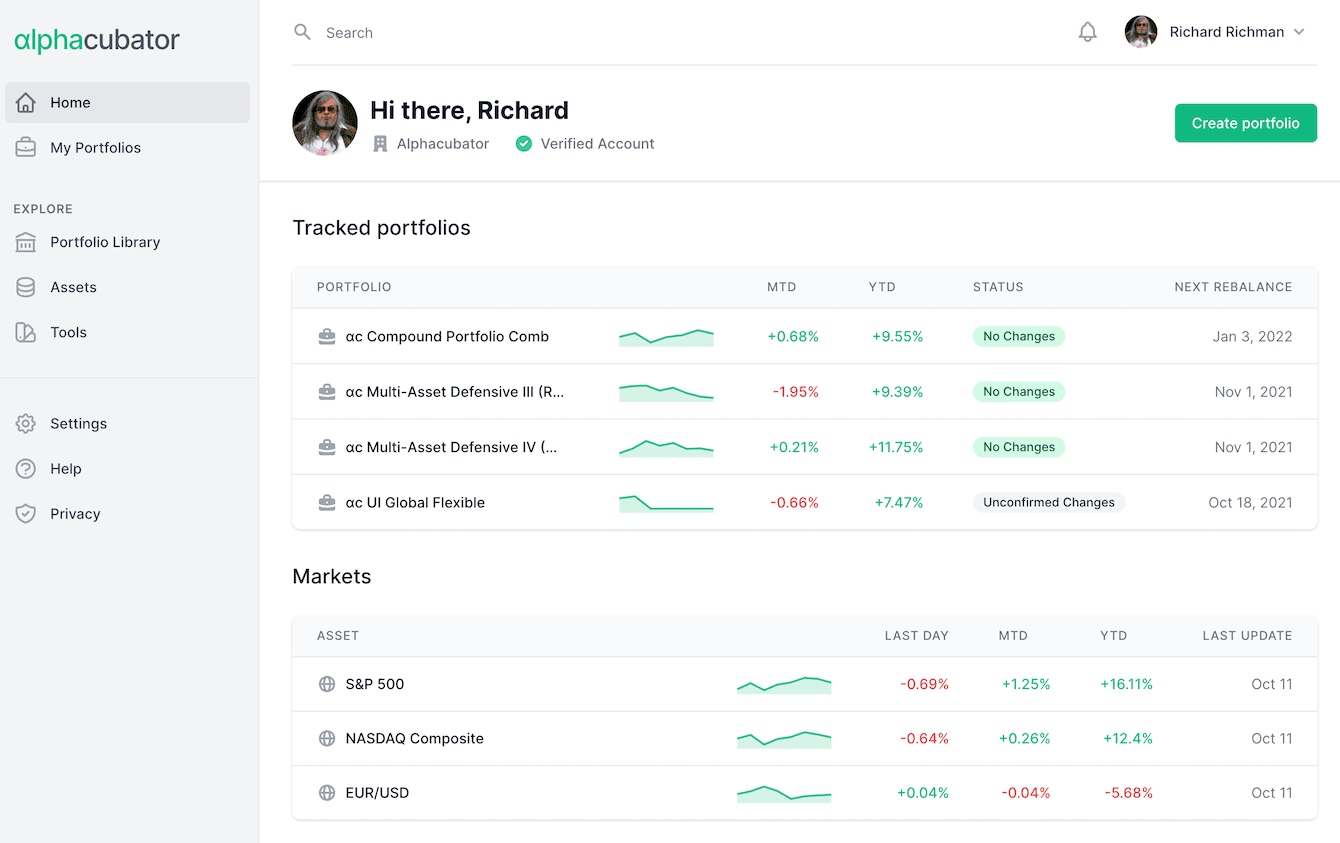

Build your own portfolio

Use stocks, ETFs, mutual funds or indices to build your ideal portfolio. Create a buy-and-hold portfolio with an optional rebalancing frequency. Or prefer a trend-based dynamic portfolio? No problem, we make it really easy. We also notify you of rebalancing changes automatically so you don't forget.