For investors

Analysis and Backtesting Tools

Build and improve your investment portfolio for more return and peace-of-mind.

Analyze your investments

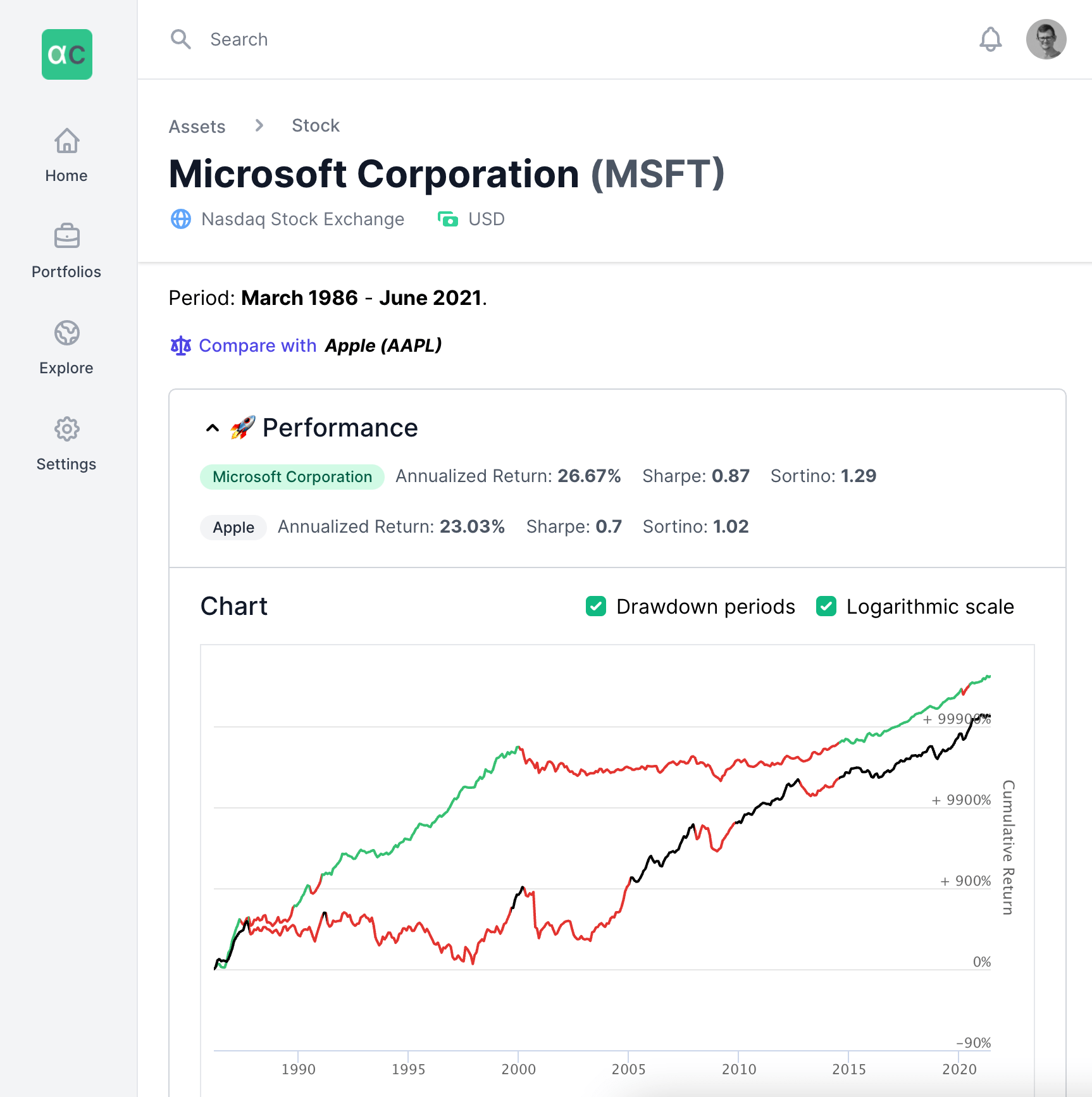

Make better informed decisions by analyzing your assets for risk and reward. How much return can I expect to make? How much risk am I taking? How does it compare to another asset? Our analysis tool got you covered.

-

Financial and Statistical Ratios

- Analyze assets with a multitude of financial and statistical ratios such as Sharpe Ratio and Maximum Drawdown.

-

Compare with other assets

- One of the best way to judge an asset is to compare it to a similar asset to see how well it performs in terms of returns as well as risk management.

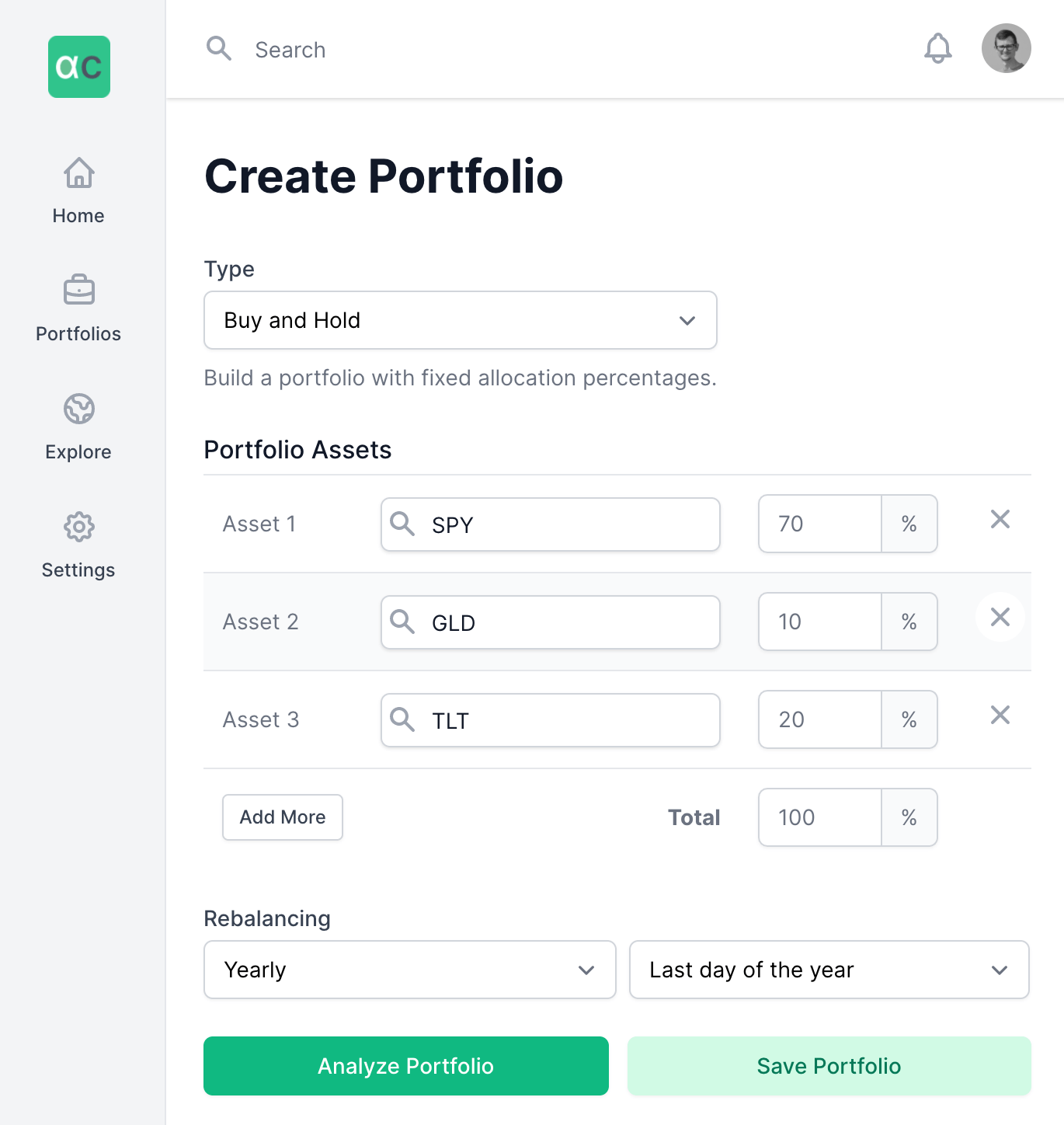

Build your own portfolio

Use stocks, ETFs, mutual funds or indices to build your ideal portfolio. Create a buy-and-hold portfolio with an optional rebalancing frequency. Or prefer a trend-based dynamic portfolio? Track rebalancing changes automatically.

-

Build simple Buy and Hold portfolios

- We have an international library of publicly traded assets, including non-public assets such as mutual funds, to build and backtest your ideal portfolio. Building a fixed-allocation portfolio is easy!

-

Build a dynamic allocation with periodic rebalancing

- Use tactical asset allocation strategies to create a dynamic portfolio with multiple assets which can be switched around based on certain rules. Define a rebalancing frequency, such as monthly, quarterly, etc., to re-execute the rules and subsequently rebalance the allocation.

-

Nested Portfolios

- Building a complex portfolio is easy. Combine multiple sub-strategies into one parent strategy. For example, create a safe-haven / bond strategy with its own assets and rules. Then incorporate this strategy inside another strategy which allocates dynamically between equities and the bonds strategy.

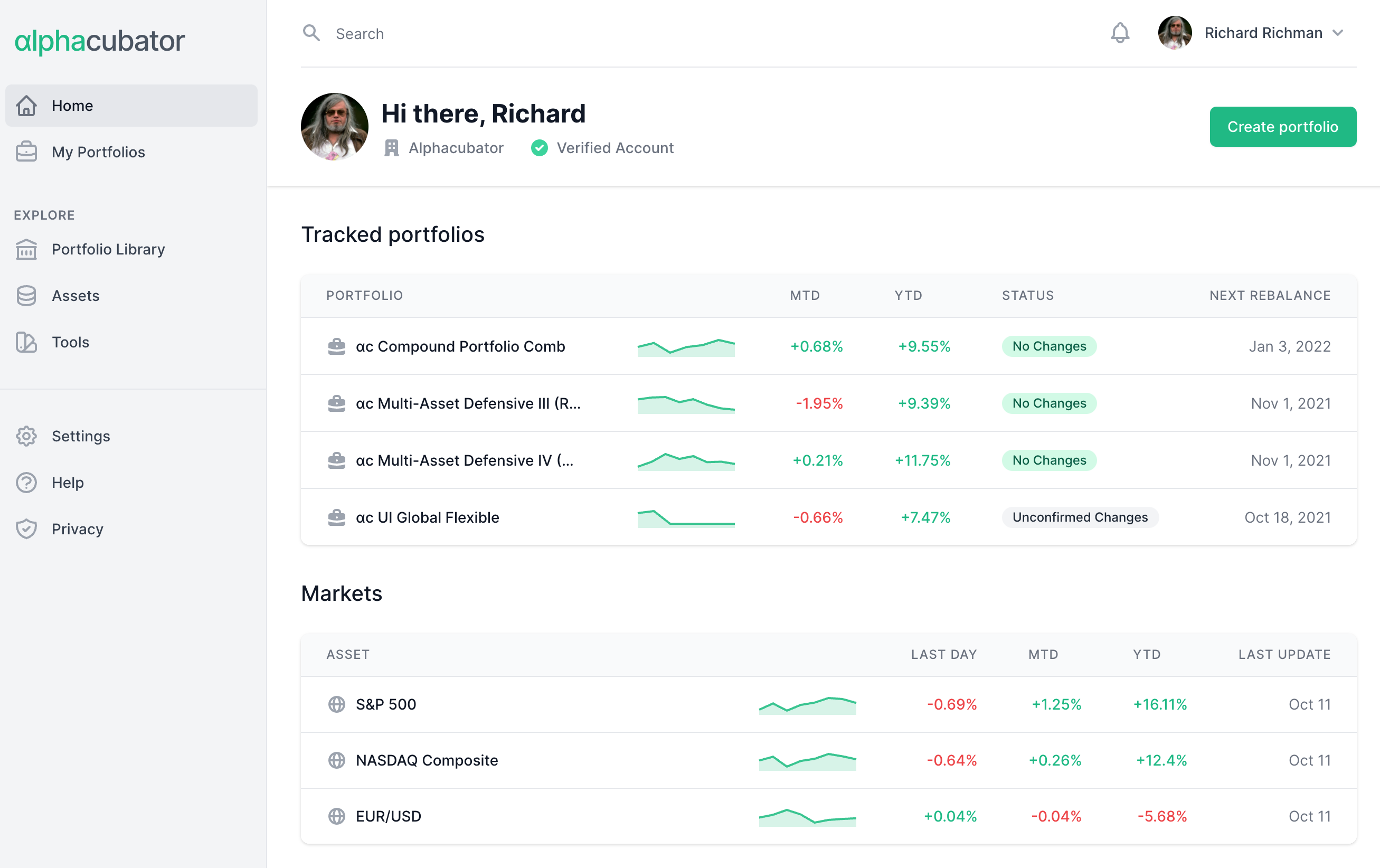

Extensive analytics and backtesting tools for investors

Use our state-of-the-art tools built for long-term DIY investors from all over the world. We're bringing hedge fund-level capabilities to retail investors.

International Assets

Beside US-based assets, we also support European and Asian domiciliated assets.

Multi Currency

Euros. Dollars. British pound. Swiss Francs. And more. Rejoice, international investors.

Long Historical Data

We have historical prices for major indices and asset classes dating back to 1970s and earlier which can be used to backtest a strategy.

Financial and Statistical Ratios

Analyze your portfolio with a multitude of financial and statistical ratios such as Sharpe Ratio and Maximum Drawdown.

Portfolio Rebalancing

Set flexible rebalancing periods, e.g. monthly, quarterly, or yearly. Start of the month? End of the month? Whatever works best for you.

Email Notifications

Stay on top of your investments and get notified when your portfolio needs to be rebalanced/changed.

Taxes and Commissions

Get as close to reality by backtesting your portfolio with transaction fees and taxes included.

Trend-based Models

Build dynamic portfolios based on tactical asset allocation (TAA) strategies for additional return and downside protection.