Improve your investment funds

Employ our quantitative tools and offer better fund performance to your clients.

Downside protection for your funds

Alphacubator provides tools to turn your equity funds into dynamic funds that offer additional downside protection against stock market downturns. Let clients switch dynamically between your equity and bond fund based on a trend-following algorithm.

-

Use your house funds

- Switch between two of your own house funds. An existing equity fund which your clients are already invested in. And one bond or money-market fund for added protection to switch to when the algorithm tells you so.

-

Trend-following algorithm

- We set up a trend-following algorithm which tells you when to invest in the equity fund, and when it's time to leave equities and switch to your defensive bond fund.

-

Happier clients

- During major market downturns, your clients will sleep peacefully knowing their assets have been actively protected with a bond fund. Protection against major downturns also translate to more return over the long-term.

Technical due diligence for assets

Alphacubator provides an extensive analysis tool to help you with technical due diligence when deciding which assets to include in your investment fund.

-

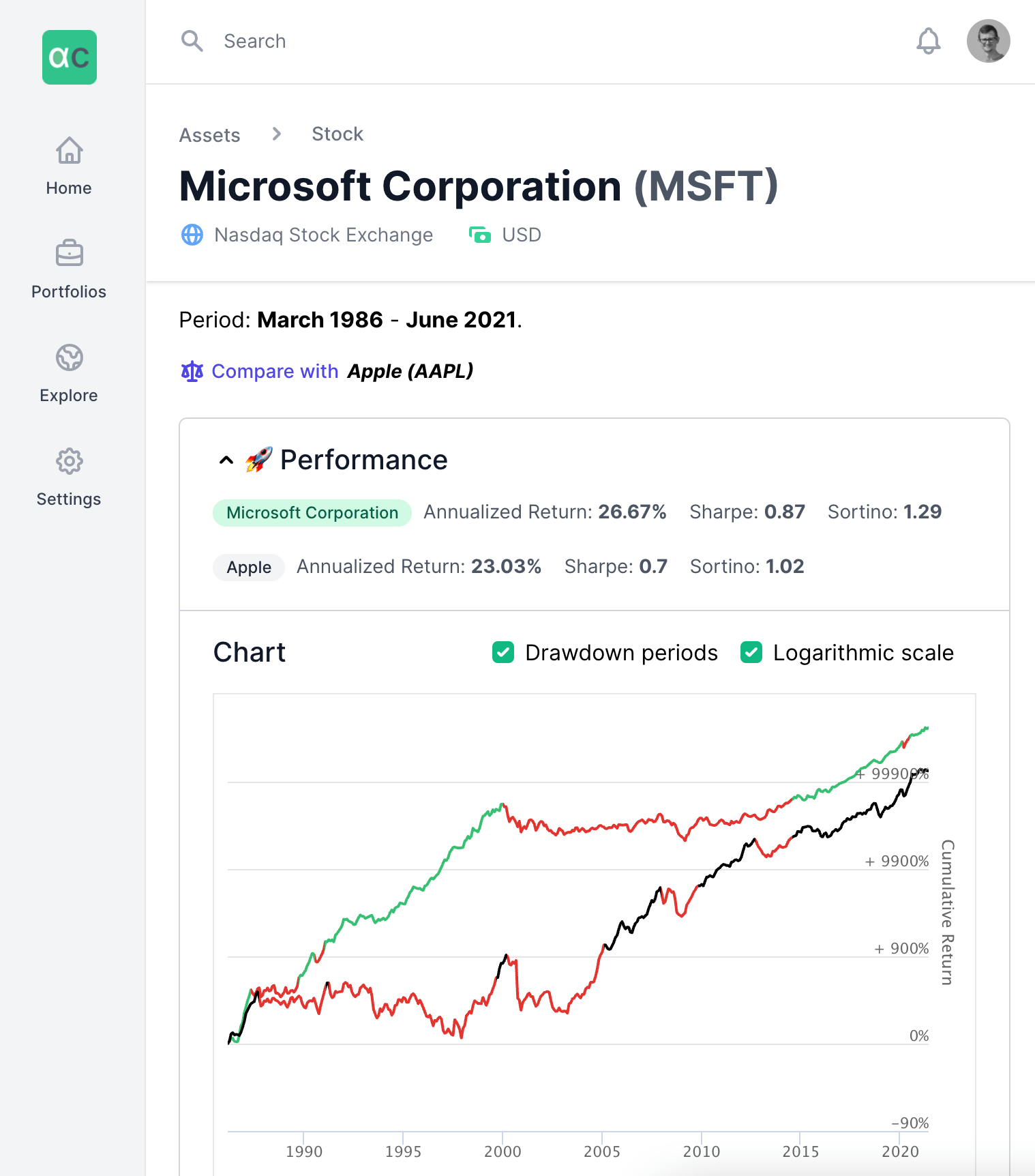

Financial and Statistical Ratios

- Analyze assets with a multitude of financial and statistical ratios such as Sharpe Ratio and Maximum Drawdown.

-

Compare with other assets

- One of the best way to judge an asset is to compare it to a similar asset to see how well it performs in terms of returns as well as risk management.

Launch fully quantitative funds

Get ahead of other local fund managers by launching your own fully quantitative fund by using our advanced portfolio builder and backtester. Our builder offers enough flexibility and features to build a solid strategy.

-

Build a dynamic allocation with periodic rebalancing

- Use tactical asset allocation strategies to create a dynamic portfolio with multiple assets which can be switched around based on certain rules. Define a rebalancing frequency, such as monthly, quarterly, etc., to re-execute the rules and subsequently rebalance the allocation.

-

Use nested strategies

- Building a complex portfolio is easy. Combine multiple sub-strategies into one parent strategy. For example, create a safe-haven / bond strategy with its own assets and rules. Then incorporate this strategy inside another strategy which allocates dynamically between equities and the bonds strategy.

-

Import custom assets

- We have an international library of publicly traded assets, including non-public assets such as mutual funds, but if you need to work with your own data series, you can easily import them as well.